Shares of Boise Cascade Co. (BCC) tumbled 10.9% toward and eight-month low, and of Louisiana-Pacific Corp. (LPX) slid 4.9% toward a 15-month low, after BofA Securities downgraded the wood products makers to neutral from buy, citing a “more bearish” view on new home demand and has wood prices have dropped sharply.

Analysts George Staphos and John Babcock also cut their price targets on Boise’s stock to $71 from $95 and on Louisiana-Pacific to $67 from $90.

The downgrades come after BofA Securities recently cut its 2023 estimate for U.S. single-family housing starts, (which use three times more wood than multi-family) to 800,000 to 900,000 from the current pace of about 1.1 million, given near-term demand risks as rising prices and interest rates have led to the lowest levels of affordability in about 16 years.

The latest data on housing starts showed a plunge to a two-year low in May. In addition, the analysts said the reasons to be bullish, such strong earnings resulting from higher-than-average lumber pricing, rising new home and repair/remodel construction expenditures and tight supply chains on transportation, have already “largely played out.”

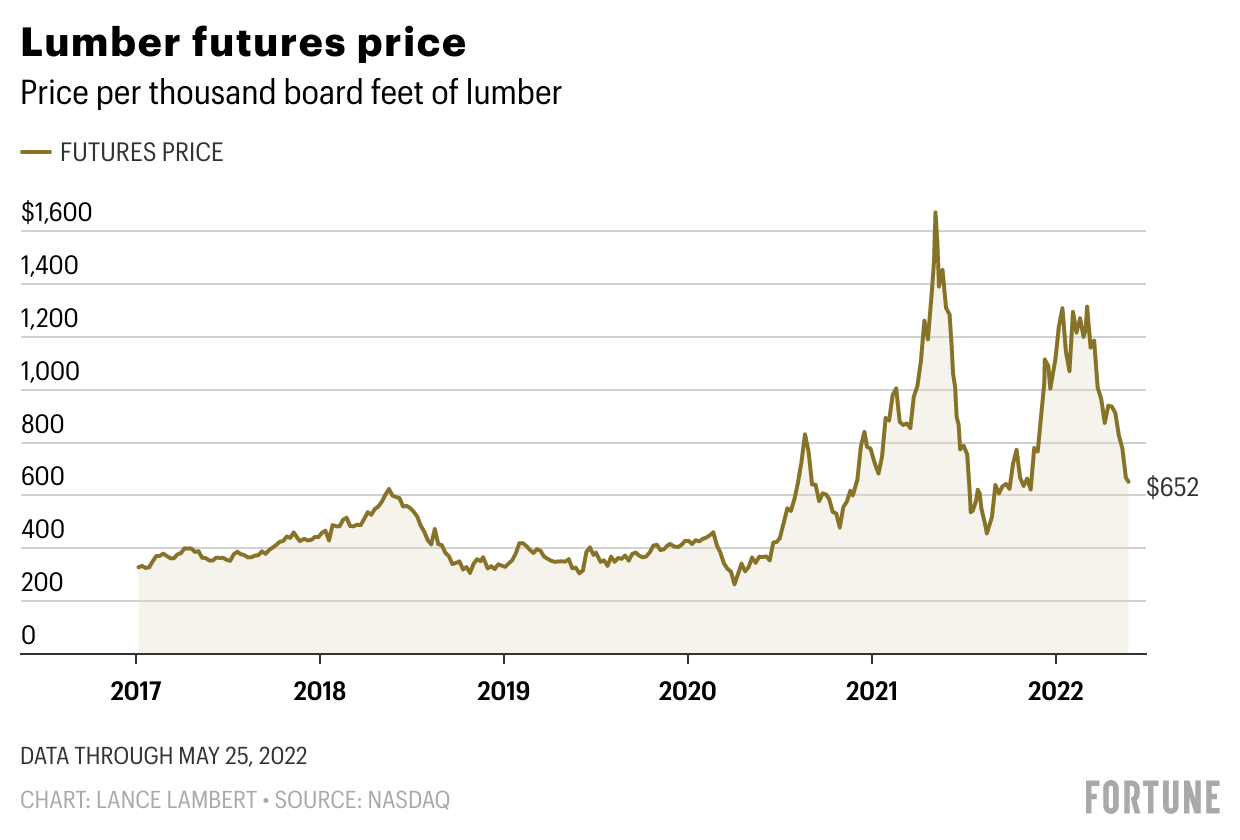

And lumber futures have tumbled 47.7% year to date, while the S&P Goldman Sachs Commodity index has run up 32.2%. Boise’s stock has dropped 21.9% this year and Louisiana-Pacific shares have shed 35.2%, while the S&P 500 has lost 21.1%.

The post North American wood products makers downgraded on lower housing demand, falling lumber prices appeared first on Global Wood Markets Info.