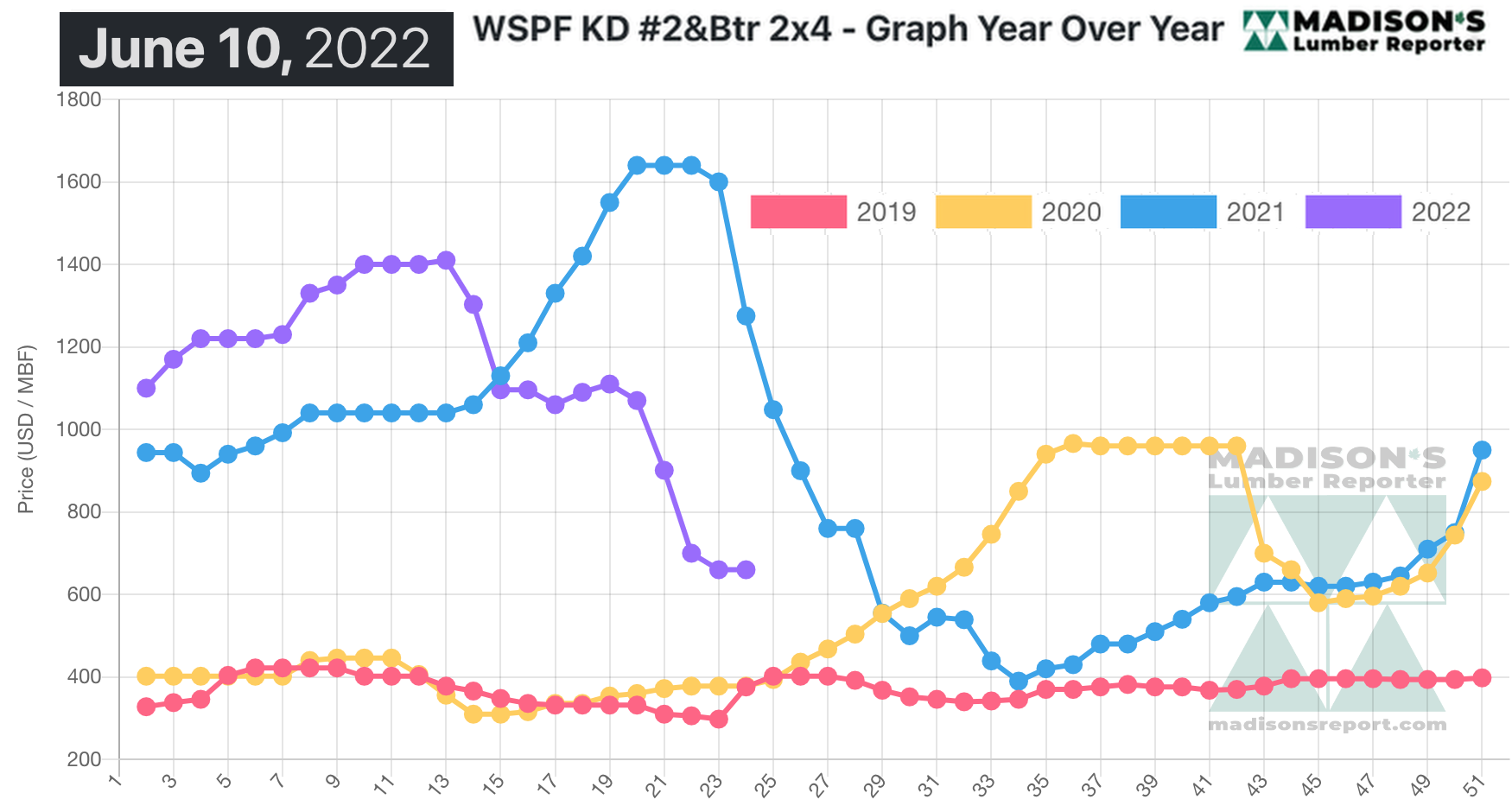

The first months of 2022 were very positive for the industry thanks to strong demand. Thanks to a stable supply of raw materials, the production of softwood lumber was able to keep up with demand – albeit at very high prices. The by-products markets are also developing well. However, there are signs of a slowdown and the next few months will be very difficult amid high unpredictability, softening construction markets and rising inflation.

“While in this uncertain context no one can say what the 4th quarter will bring for the sector, it is quite safe to say that the 3rd quarter will be tough,” stated the European Organisation of the Sawmill Industry (EOS) President Herbert Jöbstl.

EOS Vice President Laubholz Maria Kiefer-Polz added the following to the hardwood market: “2021 and the first months of 2022 were positive for the industry despite high roundwood prices. The next few months are likely to become more problematic due to a general market slowdown and further increases in commodity prices. Logistics is a problem in the Black Sea. The oak sector continues to be hampered by unsustainable log exports and oak log prices in particular have skyrocketed. But we have to remain positive as we know that wood products have a solid environmental record and are fundamental in the fight against climate change.”

In summary, EOS members agree that the demand for wood products is solid and wood is gaining increasing recognition among consumers, but the challenges on the supply side are multiple.

The post The European sawmill industry is skeptical about Q3/2022 appeared first on Timber Industry News.