Generally, in June there is a supply and demand imbalance in China as the seasonal demand drops during the Chinese hot season, and the global slug of volume that has been delivered over the Chinese New Year holiday pushes inventory levels higher than what the customers’ financiers are comfortable with. In this scenario, it’s reasonably easy to see the price drop coming (by monitoring in-market inventory increase) and relatively predictable as to when it will revert (again, based on inventory reduction).

True to form however, 2022 is different. The sharp price drop this time around has come about for a number of non- inventory specific reasons with freight cost and demand being the two key drivers. Although construction in China has tight since the Evergrande downfall last year, the current demand issue is more due to the continued Chinese covid elimination strategy which has seen 93 out of the top 100 cities locked down.

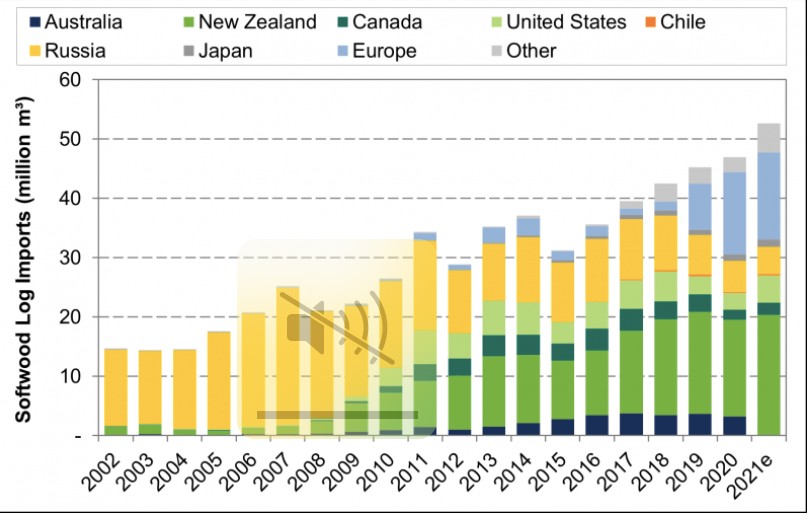

Underlying demand for NZ logs is still relatively solid as supply has dried up from Europe, the Pacific northwest and Russia. So long as the war in Ukraine continues, it’s unlikely supply will resume from these regions.

Shipping costs are completely out of control now, contrary to what we had initially expected, the Ukraine situation has created more demand for energy and grain in Europe resulting in vessels leaving the Pacific for the more lucrative Atlantic region. Current freight costs are over double those of around 18 months ago and freight is now more than half of the sales price of export logs.

Covid and general lack of labour continues to constrain port operations with many ports bursting at the seams – a problem that this current price level is likely to fix rather quickly. It is very likely that NZ supply will drop around 40% over the next few months as many forests either shut down or drop production significantly. It generally takes 6 weeks for this reduction to be felt in China and, if history is anything to go by, the rebound will be very sharp and likely starting in August.

The post Rebound in China’s log imports expected from August appeared first on Timber Industry News.