Published / Reported by WOOD PRICES

Hakan Ekstrom

EXCERPT

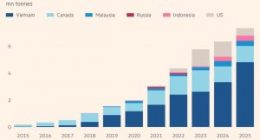

The US South softwood timber resource is significant, cost-competitive, and increasingly crucial for the global supply of several forest products. In 2020, an estimated 12% of the world’s conifer timber harvest was in this region. A large softwood timber inventory has built up in the southern US over the past 15 years. In 2000, timber harvests almost equaled net growth, but during the housing crisis and great recession in 2007-2009, lumber production, sawlog demand, and log removals fell sharply, leading to increased softwood timber inventory. Over the past decade, softwood sawlog demand has increased as sawmill production has recovered. The higher log consumption has led to a decline in the discrepancy between the timber harvests and growth, reducing the build-up of additional log surplus.

There remains, however, a large gap between the softwood timber harvest (drain) and the net growth on the US South productive forest land (the estimated drain was about 62% of growth in 2020). Although there is a softwood timber surplus for this US region, there are micro-markets where supply is becoming tighter, namely in the Atlantic states, predominantly South Carolina, Georgia, and Florida. At the same time, there are healthy surpluses in most of the Gulf States. Over the next decade, the US South will enter a new phase where the softwood stock is no longer increasing, and the timber removals could overtake the growth rates in some states.

In a new Focus Report: US South Softwood Industry – Outlook for the world’s most important softwood fiber basket, the consulting companies Wood Resources International (WRI) and O’Kelly Acumen establish a fact base around current forest resources and industry in the Southern US. The study provides predictions on likely developments of future wood supply and forest industry expansion and discusses the impacts these factors will have on global wood markets. The report also highlights what the implications of these developments will be for timberland owners, stumpage rates, and roundwood prices.

The US South has attracted increased interest and investments not only from North America but also from Europe and Asia because of the region’s surplus of timber supply and low wood costs. Sawlog prices in the region have been among the most competitive globally and consistently been low for over a decade. From 2011 to 2021, US South sawlog prices have been 10-30% below the Global Sawlog Price Index (GSPI). The pattern is similar for softwood pulplogs and wood chips, with prices being substantially below the global wood fiber price indices in the past decade.

The outlook for sawlog prices is that there will be a widening gap between micro-markets with tightening log supplies and those with large softwood surpluses. On the other hand, prices for pulpwood are likely to remain at current levels or could even decline in the midterm due to limited changes in wood fiber demand and an increase in the supply of sawmill residues and pulplogs.

The post The Large Softwood Timber Surplus in the US South is Likely to Diminish Over the Next Decade, Resulting in Regional Increases in Sawlog Prices, while Prices for Pulpwood will Remain Unchanged appeared first on Wood Prices.