The significant price cuts of the previous week were successful in spurring renewed demand for softwood lumber materials. Indeed, so successful that prices bounced almost back up to the levels of the week prior.

While sales volumes still were not optimal, looming seasonal curtailments motivated somewhat reluctant customers to pull the trigger and buy. That sales boost was enough to prompt producers to raise their prices. The oncoming dual Canada Day and U.S. Independence Day long weekends normally signal the true slowdown of softwood lumber sales, with the annual price lows approaching.

It is not known yet whether this year will see the usual seasonal price cycle; a lot depends on macroeconomic conditions like housing starts, and on weather emergencies like storms, floods, or fires.

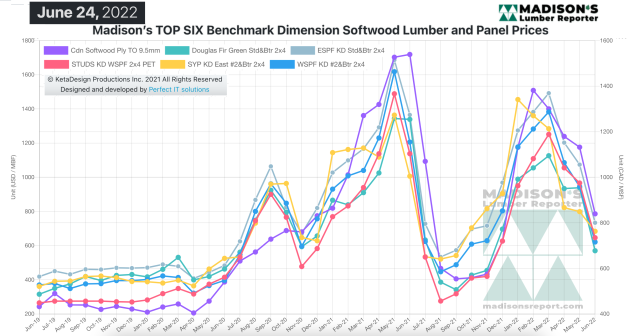

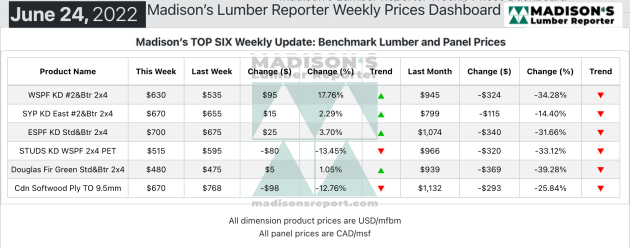

Bouncing hard from a big drop the previous week, for the week ending June 24, 2022, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was again US$630 mfbm. This is up by US$95, or 18 per cent from the previous week when it was US$535 but is down by US$315, or 33 per cent, from one month ago when it was US$945.

Buyers were further persuaded to jump in with purchases sooner than later as British Columbia sawmills noted that stumpage fees were slated to increase on July 1st.

“Most dimensional lumber and stud items appeared to put in a price bottom, while panel prices continued to peel off.” — Madison’s Lumber Reporter

Spurred on by a combination of flattening prices, upward movement in lumber futures, and their own bare field inventories, a large contingent of Western S-P-F buyers in the U.S. got off the fence and dealt. Customers looking to Canadian producers began to scramble a bit as the logistical equation on those orders was complicated by maintenance-related sawmill shutdowns planned for early July.

Canadian Western S-P-F lumber purveyors heaved palpable sighs of relief in unanimously reporting that a price bottom had been reached by midweek. Prices were still indeterminate in many cases, but buyers were certainly more active than they were recently, as they saw numbers evening out. Many decided they couldn’t wait any longer, particularly in view of the typical summer shutdowns scheduled for early July. While there were still deals to be had on much of the prompt material at both regional and national mills, that availability dried up quickly.

“Producers of green Douglas-fir lumber and studs put the brakes on further price corrections as demand ramped up. Many buyers found their preferred price levels and pulled the trigger, especially on 2×4 R/L #2&Btr and nine-foot studs. Prompt shipment still abounded, with some sawmills reporting July 11th order files on stronger items. Transportation was a mill-to-sawmill affair.” — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$900 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending June 24, 2022, was down by US$270, or 30 per cent. Compared to two years ago when it was US$436, that week’s price is up by $194, or 44 per cent.